PGA Tour Strikes $3 Billion Deal With American Investment Group Begging The Question If Saudi PIF Merger Ever Happens

The PGA Tour has finalized a deal with Strategic Sports Group, a consortium of American billionaires, worth a reported $3 billion, at least, to form a new for-profit entity called PGA Tour Enterprises.

The Strategic Sports Group is headlined by Atlanta Falcons owner Arthur Blank, Fenway Sports Group Principal John Henry and chairman Tom Werner, New York Mets owner Steve Cohen, and Milwaukee Brewers owner Mark Attanasio, among others.

Tour players will have the opportunity to become equity holders in PGA Tour Enterprises.

"Nearly 200 PGA Tour members will have the opportunity to become equity holders in this new company," the Tour's statement sent to players read. "PGA Tour Enterprises is also considering participation by future PGA Tour players that would allow them to. benefit from the business's commercial growth. Under this program, players would collectively access over $1.5 billion in equity in PGA Tour Enterprises."

In the simplest terms, it appears an allotment of somewhere in the ballpark of $1.5 billion could be set aside for the top players on the Tour to benefit from. In looking at equity being a part of this equation, it appears a potential merger between the Tour and Saudi PIF would involve the Saudis buying a share of the equity in PGA Tour Enterprises from the Strategic Sports Group.

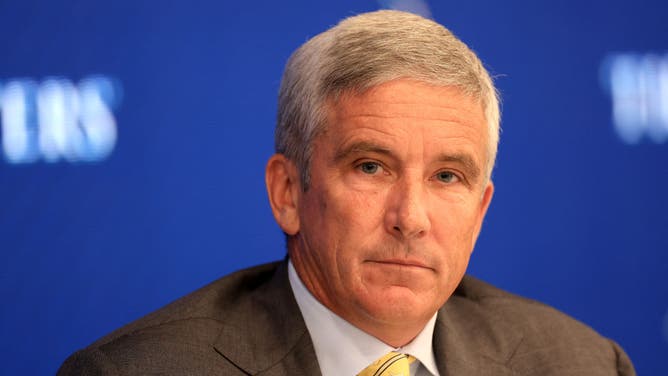

Tour commissioner Jay Monahan will reportedly be the CEO of PGA Tour Enterprises.

The PGA Tour has struck a deal with the Strategic Sports Group. (Photo by David Cannon/Getty Images)

The Tour acknowledged it was in discussions with a number of different investment groups in 2023, but the fact that the Saudi Public Investment Fund (PIF) isn't the first to pay for a seat at the table still comes as a surprise.

PGA Tour commissioner Jay Monahan sat next to Saudi PIF governor Yasir Al-Rumayyan on cable news to announce a framework agreement between the two sides, plus the DP World Tour, on June 6, 2023. This portrayed the idea that the Saudis would be the first to invest billions to create this new for-profit entity with the Tour, and that step felt imminent, yet nearly eight months later the Saudis and the Tour are still in negotiations.

Since the framework agreement for a merger was announced the Tour and the PIF have only seemed to grow further apart, at least from a public perspective.

LIV Golf, which is solely funded by the Saudi PIF, has continued to poach players away from the Tour since last June with Jon Rahm and Tyrrell Hatton being the two biggest names to jump ship from the Tour. Many have speculated that LIV's continuation of 'taking' players from the PGA Tour amid ongoing negotiations is nothing but the Saudis giving the Tour the middle finger as talks drag on.

The PGA Tour, Saudi PIF, and DP World Tour had originally set a deadline to come to terms for December 31, 2023, but have now set the goal of getting things across the line before the Masters coming up in April.

The Tour's memo does address the ongoing negotiations between itself and the Saudi PIF stating the SSG transaction "allows for co-investment from the Public Investment Fund (PIF) in the future, subject to all necessary regulatory approvals."

What SSG's Investment Into The PGA Tour Means For LIV Golf And The Divide In The Sport

It's important to remember that the original framework agreement, and any rumored new iteration, never included the prospect of LIV Golf merging the Tour or simply ceasing to exist. The investment agreement between the Tour and Strategic Sports Group doesn't change that, it may have distanced the two entities even further.

Jay Monahan and Yasir Al-Rumayyan have reportedly only met in person once since June's announcement. (Getty Images)

The U.S. Department of Justice is involved in all of this as well, but that hurdle may have shrunken a bit with the Tour electing to do business with American investors.

The DOJ has claimed antitrust and anticompetitive practice between the Tour and LIV Golf since the Saudi-backed circuit's inception in 2022. LIV being allowed to poach players away from the Tour cooled off those claims from the DOJ, and adding American dollars into the fold and keeping the Tour and LIV separate cools those anticompetitive flames even more so.

Now the question becomes whether or not the PGA Tour and its new American investor group are eager to push negotiations further with the Saudi PIF or continue to play the waiting game.

A $3 billion investment is significant, but it's a lot less significant when comparing it to a PIF valued at well over $700 billion such as the Saudi's.

The Tour announcing the investment by the SSG is refreshing given that it offers up concrete details about the immediate future, but the number of questions about the future of professional golf still far outweighs the answers at the moment.

Follow Mark Harris on X @itismarkharris and email him at mark.harris@outkick.com