Latest on UFC's Future: Netflix? ESPN and Amazon? TNT and DAZN?

The UFC's exclusive broadcast deal with ESPN expires later this year, at the end of 2025. The market for the promotion is likely to be strong, considering its growth from taboo to niche, from niche to one of the four biggest professional sports leagues in America.

Sorry, NHL. You are now fifth.

The New York Post reported over the weekend that the UFC prefers to sign with Netflix, the exclusive broadcast home of sister company WWE's Monday Night Raw. Of course, it is. Netflix is the largest streaming service in the world—it's not close. Far more viewers would consume the UFC on Netflix than any other streamer.

There's an argument that Netflix will soon be a better option for American sports leagues than cable, given the international ability of the former and the endless decline of the former.

That said, Netflix is adamant that it will not sell pay-per-views as an add-on to its service (like ESPN+ does for monthly UFC events). And making the economics work without selling pay-per-views could be challenging.

NEW YORK, NEW YORK - NOVEMBER 16: (L-R) President-elect Donald Trump holds the UFC heavyweight championship belt whilst Jon Jones of the United States of America celebrates after Jones' TKO victory against Stipe Miocic of the United States of America in the UFC heavyweight championship fight during the UFC 309 event at Madison Square Garden on November 16, 2024 in New York City. (Photo by Chris Unger/Zuffa LLC)

UFC to Netflix?

The UFC would be fine with abandoning the pay-per-view model for the right price. Mark Shapiro, the COO of the UFC's parent company TKO, made that clear earlier this month.

"Life has changed on the pay-per-view front," Shapiro said. "Look, it works for us, but we are super flexible. Linear, broadcast, streaming, pay-per-view, not pay-per-view."

To make a deal with Netflix, the streamer would have to pay the UFC upfront to air monthly events at no extra cost, relying on new subscribers and advertising revenue. And therein lies the concern.

Historically, broadcasters have struggled to monetize combat sports without selling the biggest fights on pay-per-view. In 2019, DAZN offered all of its fights as part of its standard $10-a-month package. It didn't work. NBC tried offering boxing fights for free in 2015. That didn't work either.

WWE is the exception, having successfully moved its pay-per-views to WWE Network in 2013 and NBC's Peacock in 2021. However, WWE has a much larger audience week to week than either UFC or boxing.

By some measurements, WWE has a larger weekly audience than nationally televised NBA games.

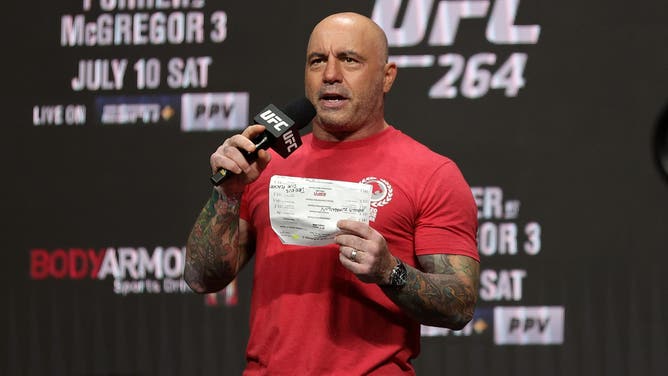

LAS VEGAS, NEVADA - JULY 09: UFC commentator Joe Rogan announces the fighters during a ceremonial weigh in for UFC 264 at T-Mobile Arena on July 09, 2021 in Las Vegas, Nevada. (Photo by Stacy Revere/Getty Images)

UFC to Amazon or TNT Sports?

Moreover, the UFC does not have active fighters like Ronda Rousey, Conor McGregor, and Brock Lesnar to convince a brand like Netflix that its product would attract a large number of new subscribers. As popular as the UFC is, its current lack of individual star power will be a hindrance during negotiations.

Granted, the UFC will have other options if Netflix passes. MMA veteran and podcast host Brendan Schaub says sources within the promotion tell him the UFC could follow the NFL model in inking multiple deals with multiple different companies.

"I said the UFC, they're going to do what the NFL does where some of it's on Amazon, Monday Night Football's on a different network. Thursday Night Football, Sunday Football, they're kind of on a bunch of different networks," Schaub said this week.

In that scenario, the UFC could stay with ESPN and also work with, say, Amazon and Warner Bros. Discovery, the latter of which have publicly expressed interest in the promotion.

There are any number of ways the UFC could fragment its rights. Amazon Prime could stream the pay-per-views while ESPN retains the lower cards for its television network. ESPN+ and WBD's Max could rotate monthly pay-per-views. WBD could put some of the Fight Night events on TNT to fill the void of losing the NBA, while ESPN or Amazon stream the pay-per-views.

DAZN is another dark horse candidate to watch, should the UFC seek additional partners.

While none of those options are quite as sexy as Netflix exclusivity, they should lead to far more annual revenue for the UFC than the $300 million ESPN currently pays.