Atlanta Braves Release Financial Disclosures, Pulling Back Curtain On Business Of Baseball

The Atlanta Braves are now a publicly traded company, meaning fans can now technically become part owners of a professional baseball team.

That’s interesting enough, but what’s even more fascinating is that as a publicly traded team, the Braves now have to release financial disclosures on their revenues, including profits or potential losses. Meaning that after years of guessing what teams around Major League Baseball make each year, we now have concrete information on it.

And at least for the Atlanta Braves, business is booming.

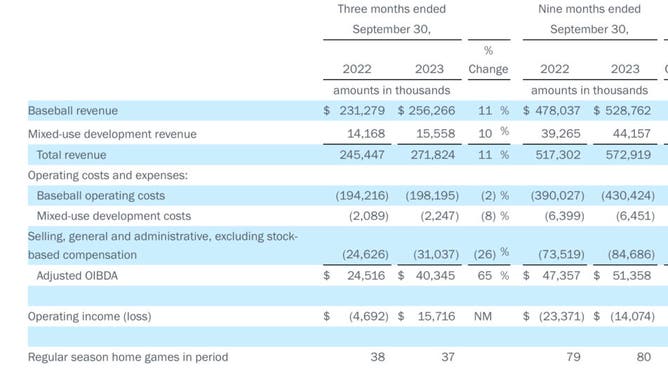

In the third quarter of the fiscal year, the Braves reported $272 million in revenue, up 11% from the year before. Of that $272 million, $256 million came from exclusively baseball-related sources. With another $16 million coming from The Battery; a mixed-use development neighboring the stadium.

For the nine months ending September 30th in 2023, the Braves reported nearly $529 million in baseball-related income, those still claimed a $14 million operating loss. The three-month period resulted in a profit of $15.7 million.

There are a number of significant revelations from this disclosure, but one key takeaway is that the business of baseball continues to grow.

HOUSTON - Jorge Soler of the Atlanta Braves celebrates after hitting a solo home run against the Houston Astros during the first inning in Game One of the World Series at Minute Maid Park on October 26, 2021. (Photo by Elsa/Getty Images)

Braves Revenues Increase, Even Without World Series Appearance

The Braves announced they sold more than 3.2 million tickets, with increased attendance leading to a higher income. Even without a deep postseason run revenues grew, indicating that hosting World Series games could lead to even bigger profits.

Another key takeaway is that income from the mixed-used development also grew, up to over $44 million in the nine-month period.

While still dwarfed by baseball-related revenue, it’s a substantial addition to their business. It makes it pretty obvious why more and more teams are looking to redevelop the areas around their stadium. Few business owners would turn down an additional ~10% of their yearly revenue.

The Braves are one of baseball’s bigger franchises, with a large market and devoted fan base. But imagine how much more revenue the Yankees, Dodgers, Red Sox or Cubs are making, considering they have even larger profiles.

The Dodgers, for example, ran payrolls that exceeded $300 million and likely still turned a profit. Last year was in the low 200’s. Imagine how much more profit that represented; they put together a competitive team with at least $80 million less in salary expenditures. Makes a lot more sense why teams are conservative with big free agent signings, doesn’t it?